Contents

- Buy Sell Signal Indicator Tradingview | Trend Finder Indicator for Entry and Exit With Super Trend

- Open Demat Account &

- Master Indicator In Tradingview | Best Tradingview Indicator For Scalping Trading Perfect Buy Sell

- “The Most Accurate Buy Sell Signal Indicator – 100% Profitable Trading Strategy” Review Trading

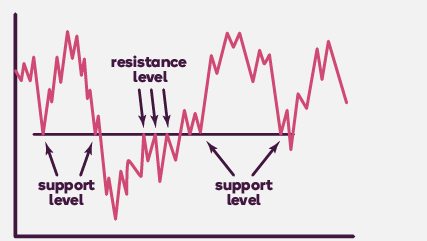

When the dots are swapped, it means that there is a possible change in the direction of the price. For example, if the dots are above the price when they roll over below the price, this could signal a further rise in price. Parabolic stop and reverse – is used to determine the price direction of an asset, as well as draw attention to when the price direction is changing, also known as “stop and reversal system”. In Forex trading traders shouldn’t risk more than they can afford to lose.

Our experts suggest the best funds and you can get high returns by investing directly or through SIP. This stage may be a preceding stage of support /resistance or a flow out of a renowned marketplace variety that has described previous trading boundaries. Update your mobile number & email Id with your stock broker/depository participant and receive OTP directly from depository on your email id and/or mobile number to create pledge.

With qualities such as these and the right fundamentals, it’s not a challenge to have success as a scalp trader. This trading style is a motivating style as it offers traders the thrill of stock market trading. Forex Scalping – This strategy is similar to the scalping strategy which is used in stocks. It may appear to be cumbersome of time-consuming to some of the investors, but it is one of the safest bets when it comes to fore market. You enter the market daily with up to two positions and carry them into another period. The more trades you scalp, the higher will be the chances of your profit.

Buy Sell Signal Indicator Tradingview | Trend Finder Indicator for Entry and Exit With Super Trend

Given the underlying principle that markets are inherently volatile, it gives scalpers enough opportunities to exploit the prices. It is less risky than day-trading as the scalpers generally execute orders instantly , which reduces the risk of market fluctuations. 4) No need to issue cheques by investors while subscribing to IPO. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. No worries for refund as the money remains in investor’s account.

If the value of currency pairs stay above the moving average, it denotes that the value is in an uptrend. On the other hand, if it goes down the moving average, it shows the price of currency pairs is in a downtrend. And, in scalping in currency pairs, you usually trade for 5 or 15-minute, but in the case of low volatile pairs, you might have to wait for an hour or more for the pair to reach your desired price level. In this part of the class, we have taken out all the different types of setups that you might get using a forex scalping strategy. These scalping examples will help a forex scalper trade to be prepared beforehand. These examples will be very useful for anyone using our strategy.

Which timeframe is best for scalping?

Scalpers usually work within very small timeframes of one minute to 15 minutes. However, the one- or two-minute timeframes tend to be favoured among scalpers. To action this strategy, you must choose a highly liquid currency pairing, and then you can open an account with us.

It uses basic arithmetic, and shows traders the average price of the security they are trading in. It helps in identifying the market trend, whether upward or downward. It is calculated by adding the closing prices in the desired time frame, and then dividing the number by the number of periods. Scalping is a method of trading in which traders book profits in small changes in price.

Open Demat Account &

Forex Scalping is a short-term strategy, the goal is to make profit out of tiny price movements. Leverage let’s traders borrow capital from a broker in order to gain more exposure to the Forex market, only using a small percentage of the full asset value as a deposit. This strategy increases profits but it can also enhance losses if the market does not move in needed direction.

This is a breakout strategy that many users enjoy to use but is not the only strategy that makes use of breakouts. You wait for the trade to breakout from the normal tight range to make your move. Many traders believe that at Risk Disclaimer these precise moments which are very rare, they can be able to make a lot of money. This is achieved by pinpointing and trading on the moving price because the movement is very forceful towards one direction or the other.

Master Indicator In Tradingview | Best Tradingview Indicator For Scalping Trading Perfect Buy Sell

Forex scalping is one of the main trading styles in the Forex market internationally and one suspects it is a much larger business than day trading, swing trading and position trading for individual traders across the world. Scalping is a trading style where the trader makes profits fromexp the minutest changes in the prices of financial security. This is considered one of the best methods to achieve financial objectives by doing goal based investing in India.

The ones listed above are some of the more popular ones, as well as user friendly ones. Some of these indicators can be used together, as well as with other indicators, however as the saying goes, too many cooks spoil the broth, so we must not over use the indicators as this could lead to confusion. The Exponential Moving Average, or EMA, is yet another useful 6 Books about Forex moving average indicator. When compared to SMA, the EMA provides detailed information on price a lot faster. And while the SMA gives preference to overall weights, the EMA gives preference to recent price.Hence EMA reacts more quickly to recent price than to overall price. They view the stock market as a warzone and consider other traders as the enemy.

“The Most Accurate Buy Sell Signal Indicator – 100% Profitable Trading Strategy” Review Trading

This is a simple scalping strategy that works for all time frames… I have only tested it on FOREX It works by checking if the price is currently in an uptrend and if it crosses the 20 EMA. If it crosses the 20 EMA and its in and uptrend it will post a BUY SIGNAL. If it crosses the 20 EMA and its in and down it will post a SELL SIGNAL. The red line is the… Volume and price have a very strong, short-term relationship, but changes in trading volume usually happen before sustained price movements. Paying attention to volume indicators makes it possible to take advantage of these movements before they actually occur.

Is forex scalping profitable?

Is forex scalping profitable? Scaping forex can be highly profitable; but it requires a lot of time, dedication and patience. When the profit margins are so tight on each trade, a single mistake can wipe out the gains from several winning trades, so risk management and discipline are essential to your success.

Start with simpler ones then progress as you keep trading and learning. The benefit of using such a strategy is that traders get to choose trades on the confluence basis which is known to occur at points of Fibonacci retracements that differ. These can be points of extension such as 38, 62, and 79 percent just to list a few. You have to note that the process used to track this confluence remains the same and doesn’t change in any way. You can perform it better by creating lines of Fibonacci on a chart and then trace where the lines overlap. When one of the band on the outer part permits the price to bounce off it which means making a move in the direction opposite to it, it’s considered ranging if it touches the second band on the outer part.

The New India Assurance: Will the Counter Assure Super Returns Soon?

That said; you can learn about these indicators with time and experience with the help of an excellent trading platform and advisory services. To learn about scalping indicators, reach out to us at Angel One. This second indicator which we will be using is one cm trading broker review of the very accurate scalping indicators. This forex scalping indicator will help you take your scalping to the next level and also help you predict the next move of the forex market. Active style of trading – scalping is a very active style of trading.

- You’re now in day trading conditions where the graph could go anywhere.

- The MACD indicator depicts a relationship between the two moving averages of the price of financial security.

- Scalping trading is to capitalise on small price movements by buying and selling almost instantly in hopes of quick profit.

- Price action can help you view supply and demand like no other tool.

- Scalping is a trading strategy that traders deploy to earn small profits from market fluctuations, often through large-volume trades many times during the market session.

Candlestick charts contain more information than simple price charts , allowing traders to understand current price trends. The traders determine a financial securities’ short term momentum, future and assists in understanding the correct time and place to put a stop-loss order with the help of this indicator. A confused trader might have to incur losses and lose out on many fantastic opportunities to maximize profits. Thus, below is a list of the few most commonly used scalping strategies futures. Thus, here are four options for scalping strategy to guide you. They will lead you towards a successful trade in the segment while practicing the scalping trading style.

What is the best time frame for scalping?

Scalping is purely an intraday trading strategy. Scalpers mainly use the 1-minute chart for their trading. However few traders may even trade on 2-minute, 3-minute or 5-minute time frame charts.

Unlike many who buy shares for the long term, these guys rely on trading within minutes. And this has led to certain characteristics about scalpers which can be listed below. Scalpers usually follow one-minute chart patterns to execute the trade as it is carried out frequently. It needs a diligent watch on the formation of the patterns and hence requires traders to have ample time and quick reflexes apart from a large risk appetite. A great deal of self-discipline and timing is required for scalping trading. New traders can reach a point of confusion while deciding which style of trading to practise.